Corporate Governance

Last update: 1 July, 2025An overview of corporate governance.

AGC Group Corporate Governance Basic Policy last up date: 1 January, 2025

Corporate Governance Report (submitted to TSE) last up date: 1 July, 2025

Articles of Incorporation

- Corporate Governance

- AGC Group Corporate Governance Basic Policy

- Mechanism for Decision Making, Monitoring, Supervision, and Audits

- Compensation and other emoluments for Directors and Audit & Supervisory Board Members

- Corporate Policy over Internal Control and Operations of Internal Control

- Introduction of Executives

Corporate Governance

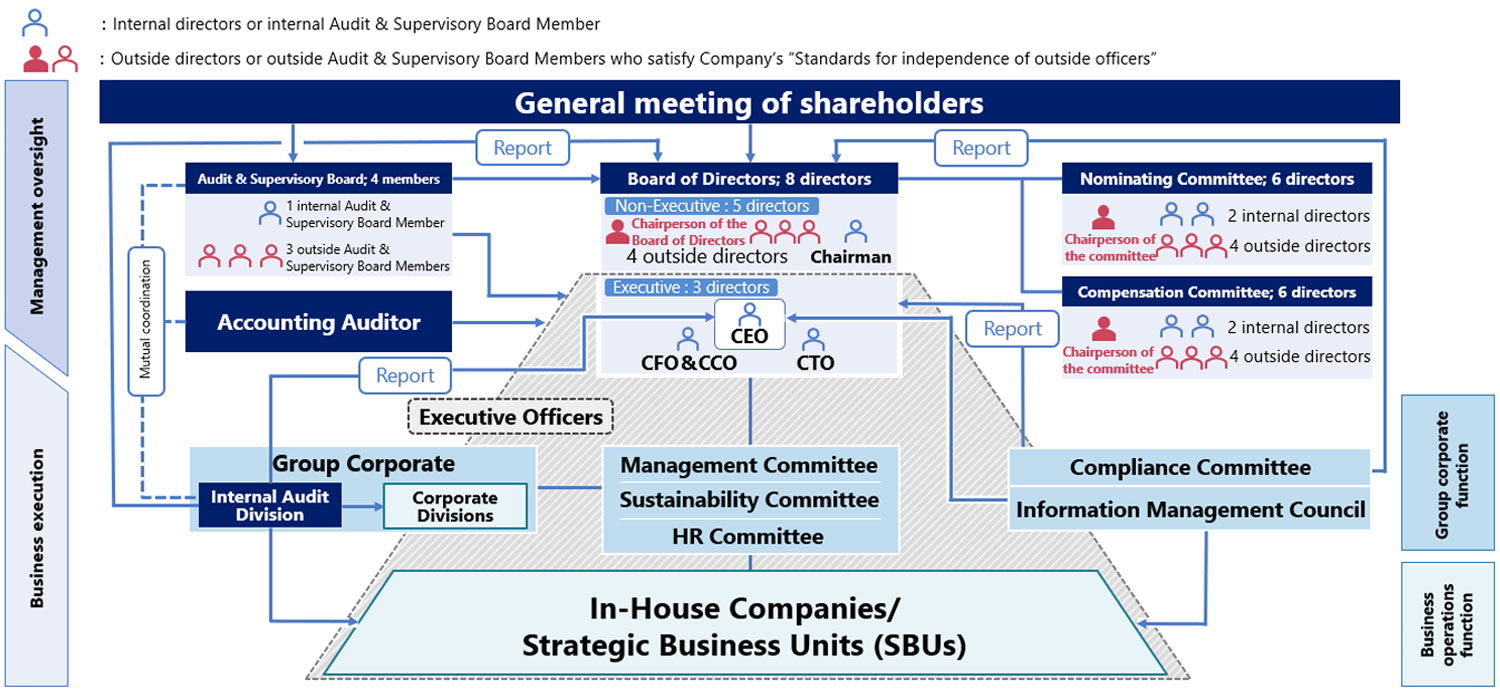

As its basic policy on corporate governance structure, AGC clearly separates the functions of "oversight" and "execution" of management, aiming to reinforce the management oversight function while ensuring quick decision-making in management execution. The management oversight function is mainly shouldered by the Board of Directors, which is a "body that approves basic policies and oversees the management of AGC." We have enhanced the objectivity and transparency of management and strengthened our corporate governance system by appointing 4 Outside Directors, out of 8 Directors in total. Aiming to further strengthen the management oversight function, AGC Inc. established the Nominating Committee and the Compensation Committee, as voluntary advisory committees of the Board of Directors. The majority of members of both committees are Outside Directors. The Company also adopts the Audit & Supervisory Board Member system, and the Audit & Supervisory Board consists of 4 Audit & Supervisory Board Members, including 3 Outside Audit & Supervisory Board Members.

The management execution function is assumed by the President & CEO and the other Executive Officers. The Company also established the Management Committee as an advisory committee for the President & CEO, and it deliberates on decision making for the Group's management and oversees the business management. With regard to the execution of business operations, the AGC Group introduced the In-House Company system; adopted a globally integrated management system; and transferred significant responsibility and authority for the execution of business operations to each In-House Company and SBU.

AGC Group Corporate Governance Basic Policy

The Company has formulated the AGC Group Corporate Governance Basic Policy (the "Basic Policy") to further enhance the Company's corporate governance with the aim of achieving both sustainable growth and mid- to long-term enhancement of corporate value.

Its full text is available below.

AGC Group Corporate Governance Basic Policy

The AGC Group's Corporate Governance Structure(Outline)

Board of Directors

| Official title | Name | Double as Executive Officer | Independent Director | Nominating Committee | Compensation Committee |

|---|---|---|---|---|---|

| Director | Takuya Shimamura*1 | - | - | ○ | ○ |

| Representative Director | Yoshinori Hirai | President | - | ○ | ○ |

| Representative Director | Shinji Miyaji | Senior Executive Vice President | - | - | - |

| Representative Director | Hideyuki Kurata | Executive Vice President | - | - | - |

| Director | Hiroyuki Yanagi*2 | - | ○ | ○ | ○ |

| Director | Keiko Honda*3 | - | ○ | ○ | ○ |

| Director | Isao Teshirogi*4 | - | ○ | ○ | ○ |

| Director | Koji Arima | - | ○ | ○ | ○ |

- *Chairman

- *Chairperson of the Board of Diriector

- *Chairperson of the Nominating Committee

- *Chairperson of the Compensation Committee

Audit & Supervisory Board Members

| Official title | Name | Independent Auditor | Chairman of The Board |

|---|---|---|---|

| (Full-time) | Isamu Kawashima | ○ | ○ |

| (Full-time) | Naoko Araki | - | - |

| Auditor | Tatsuro Ishizuka | ○ | |

| Auditor | Haruka Matsuyama | ○ |

Mechanism for Decision Making, Monitoring, Supervision, and Audits

- Directors and Board of Directors

- Structure of Board of Directors

- AGC Inc. cannot have more than 15 Directors, with the Board of Directors currently consisting of 8 Directors including 4 Outside Directors.

- To ensure the independence of Outside Directors, the Company elects Outside Directors while using as "the standards for independence of Outside Director / Audit & Supervisory Board Members" for such election the provisions concerning Outside Directors of the Companies Act and in-house regulations. Although there are business relations between the Company and companies to which Outside Directors belong, prices and other transaction terms are determined in the same way as for arm's length general transactions.

- In principle, the Board of Directors shall be chaired by an Outside Director.

- Election of Directors

- Directors are elected at a General Meeting of Shareholders. To elect Directors, the presence of shareholders owning not less than one-third of the votes of all the shareholders of the Company who are able to exercise voting rights is required, and no cumulative voting is used for that purpose.

- Term of office of Directors

- The term of office of Directors is 1 year.

- Holding of Board of Directors meetings

- In fiscal 2024, the Company held 14 meetings of the Board of Directors.

- Compensation

- Directors' compensation discloses the respective total amounts of Monthly Compensation, Bonuses, and Stock Compensation in the Business Report.

- The compensation system consists of "Monthly Compensation" as a fixed compensation, and variable compensation in the form of "Bonuses" and "Stock Compensation".

- For Directors who also serve as Executive Officers, and for Executive Officers, compensation consists of three components for Monthly Compensation, Bonuses, and Stock Compensation; for Directors not serving as Executive Officers (including Outside Directors), compensation consists of Monthly Compensation and Stock Compensation. Corporate Auditors are paid only Monthly Compensation.

- The Company does not adopt a retirement benefit system for Directors.

- Structure of Board of Directors

- Nominating Committee

- Structure

- The Nominating Committee consists of up to 6 Directors, with a majority of the members being Outside Directors. At the moment, the committee is composed of 6 Directors, including 4 Outside Directors.

- The Nominating Committee shall be chaired by an Outside Director.

- Frequency of Nominating Committee meetings

- The Nominating Committee held 10 meetings in fiscal 2024.

- Structure

- Compensation Committee

- Structure

- The Compensation Committee consists of up to 6 Directors, with a majority of the members being Outside Directors. Currently, the committee is composed of 6 Directors, including 4 Outside Directors.

- The Compensation Committee shall be chaired by an Outside Director.

- Holding of Compensation Committee meetings

- The Compensation Committee held 6 meetings in fiscal 2024.

- Structure

- Audit & Supervisory Board Members and Audit & Supervisory Board

- Structure of Audit & Supervisory Board

- The Company cannot have more than 5 Audit & Supervisory Board Members, with the Audit & Supervisory Board currently consisting of 4 Audit & Supervisory Board Members, including 3 Outside Audit & Supervisory Board Members.

- Election of Audit & Supervisory Board Members

- Audit & Supervisory Board Members are elected at a General Meeting of Shareholders. To elect Audit & Supervisory Board Members, the presence of shareholders owning not less than one-third of the votes of all the shareholders of the Company who are able to exercise voting rights is required.

- Audit & Supervisory Board elects full-time Audit & Supervisory Board Members by its resolution. Currently, the Company has 2 full-time Audit & Supervisory Board Members.

- Term of office of Audit & Supervisory Board Members

- The term of office of Audit & Supervisory Board Members is 4 years.

- Establishment of Audit & Supervisory Board Secretariat

- The Audit & Supervisory Board Secretariat has been established to assist Audit & Supervisory Board Members in their duties.

- Independence of staff of the Audit & Supervisory Board Secretariat from Directors

- Any transfer or evaluation of staff of the Audit & Supervisory Board Secretariat requires the approval of the Audit & Supervisory Board.

- Holding of Audit & Supervisory Board meetings

- The Audit & Supervisory Board held 14 meetings in fiscal 2024.

- Compensation

- Compensation for Audit & Supervisory Board Members is paid only on a monthly basis, and its total monthly amount is disclosed in the Business Report.

- Others

- The Company has no personal, capital or business relationships or other conflicts of interest with Outside Audit & Supervisory Board Members.

- Structure of Audit & Supervisory Board

- Accounting Auditor

- Election of Accounting Auditor

- Accounting Auditor is elected at a General Meeting of Shareholders.

- The Company's current Accounting Auditor is KPMG AZSA LLC.

- Compensation for audit service

- In fiscal 2024, the Company and its domestic consolidated subsidiaries paid 259 million yen to the Accounting Auditor KPMG AZSA LLC. as compensation for the service stipulated in Article 2, Paragraph 1 of the Certified Public Accountants Law (Law No. 103, 1948). In addition, the Company paid 9 million yen to an Accounting Auditor for completing the agreed duties.

- Amounts less than 1 million yen discarded when they are indicated by the unit of a million yen.

- In fiscal 2024, the Company and its domestic consolidated subsidiaries paid 259 million yen to the Accounting Auditor KPMG AZSA LLC. as compensation for the service stipulated in Article 2, Paragraph 1 of the Certified Public Accountants Law (Law No. 103, 1948). In addition, the Company paid 9 million yen to an Accounting Auditor for completing the agreed duties.

- Election of Accounting Auditor

Compensation and other emoluments for Directors and Audit & Supervisory Board Members

Compensation and other emoluments for Directors and Audit & Supervisory Board Members: number of recipients and amount of payment

| Number of recipients and amount of payment | Breakdown | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Fixed compensation | Variable compensation | ||||||||

| Monthly compensation | Bonus

(Amount of bonuses for the fiscal year under review) |

Stock Compensation | |||||||

| Number of recipients

(persons) |

Amount of payment

(¥million) |

Number of recipients

(persons) |

Amount of payment

(¥million) |

Number of recipients

(persons) |

Amount of payment

(¥million) |

Number of recipients

(persons) |

Amount of payment

(¥million) |

||

| Directors | 7 | 628 | 7 | 368 | 3 | 122 | 7 | 137 | |

| Outside Directors | 3 | 57 | 3 | 52 | - | - | 3 | 5 | |

| Audit & Supervisory Board Members | 4 | 100 | 4 | 100 | - | - | - | - | |

| Outside Audit & Supervisory Board Members | 3 | 64 | 3 | 64 | - | - | - | - | |

Policy for Determining Compensation and Other Emoluments for Officers

- Compensation Policy

- Basic Philosophy on Compensation System

The Company sets out, as its compensation principles, its basic philosophies on overall compensation for officers as follows.

- The compensation system shall be one that enables the Company to attract, secure and reward diverse and talented personnel, in order to establish and expand the Company’s edge over its peers.

- The compensation system shall be one that promotes continued improvement of corporate values, and in this way allows shareholders and management to share gains.

- The compensation system shall be one that motivates the management to achieve performance goals relating to management strategies for the AGC Group’s continuous development.

- The decision-making process of determining compensation shall be objective and highly transparent.

- Composition of Compensation

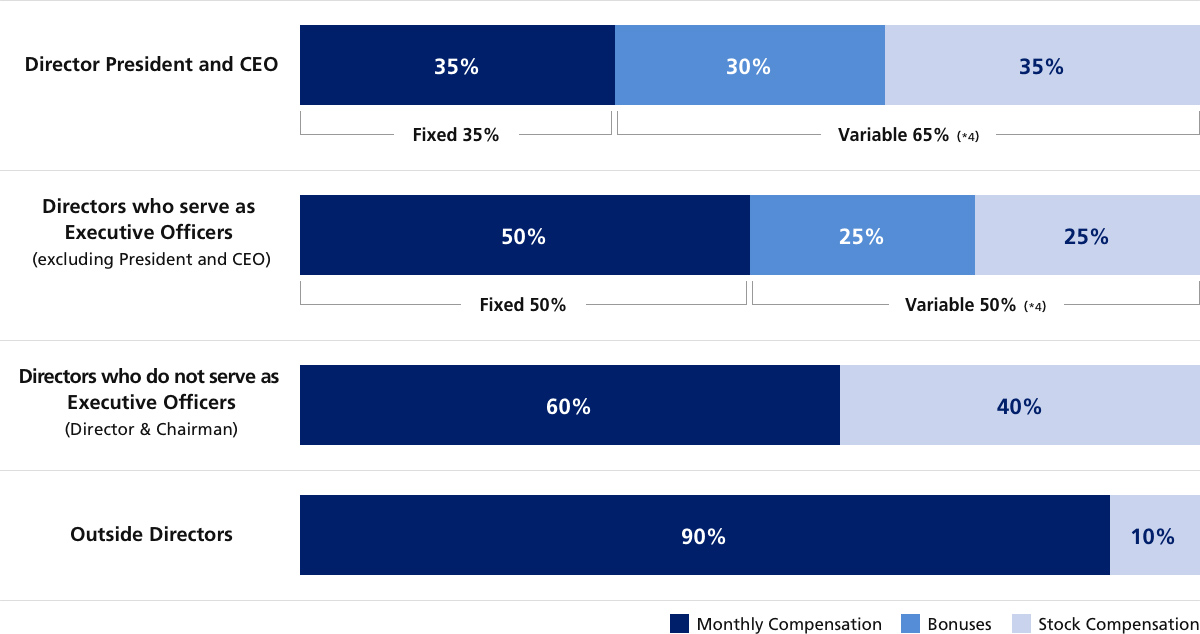

- Compensation for the Company’s officers consists of “Monthly compensation” as fixed compensation and “Bonuses” and “Stock compensation (*1)” as variable compensation. The Company’s officers are eligible for the following compensation according to their positions.

Classification Fixed compensation Variable compensation Monthly compensation Bonuses Stock compensation Performance-linked component Fixed component(*2) Directors who serve concurrently as Executive Officers, and Executive Officers ○ ○ ○ ○ Directors who do not serve concurrently as Executive Officers (including Outside Directors) ○ - - ○ Audit & Supervisory Board members ○ - - - - (*1) In the event that persons eligible for Stock Compensation are non-residents of Japan, the Company may, instead of delivering shares, make a cash payment in an equivalent amount as a bonus payment to such persons.

- (*2) The fixed component of the stock compensation is not linked to the Company's performance.

- The proportion of each component of Directors based on the standard payment amount shall be approximately as follows (*3), and especially the variable compensation shall be determined by reflecting details of (3) Scheme of Variable Compensation” below.

- (*3) If an officer does not fall under any of the classifications, the matter shall be deliberated by the Compensation Committee and approved by the Board of Directors.

- (*4) Variable compensation shall be the total of bonuses and amount of stock compensation for a single fiscal year.

- Compensation for the Company’s officers consists of “Monthly compensation” as fixed compensation and “Bonuses” and “Stock compensation (*1)” as variable compensation. The Company’s officers are eligible for the following compensation according to their positions.

- Scheme of Variable Compensation

Variable compensation takes into account a balance among each of short-, medium-, and long-term periods, to allow management functions to be carried out from a well-balanced perspective in each term, in order to achieve sustainable growth and enhance the corporate value of the AGC Group.

- Bonuses

- An amount according to each officer’s position is adjusted in accordance with the consolidated performance indicators for a single fiscal year, in order to further enhance the motivation to achieve performance goals for a single fiscal year.

- The indicators of performance shall be Return (Operating Profit) on Capital Employed(*5) and Cash Flow, considering the importance of improving business profitability and asset efficiency, as well as generating cash flows.

- (*5) Return (Operating Profit) on Capital Employed = Operating Profit/Operating Assets

- The payout % shall vary depending on the level of achievement of the target for Return (Operating Profit) on Capital Employed and improvement of Cash Flow compared to the previous fiscal year. In principle, the payout % shall vary between 0% and 200% of the standard payment amount, taking into account company-wide performance, reinforcement of non-financial capital, progress in portfolio conversion and other conditions, as well as individual performance. The payout % shall be determined by a resolution of the Board of Directors after deliberation by the Compensation Committee.

- Bonuses cover the period from the beginning of the fiscal year to the final day of the fiscal year, and are paid immediately after the first annual general shareholders' meeting held after the end of the target period.

- Stock compensation

- The Stock compensation plan (the “Plan”) is intended to enhance the motivation to contribute to medium- to long-term improvements in the corporate value of the AGC Group, and to promote a sharing of interests with shareholders, as well as to further enhance the motivation to achieve the performance goals in the mid-term management plan (the “mid-term plan”).

- Compensation under the Plan consists of a performance-linked component, whereby the Company’s shares, etc. to be delivered will vary depending on the position and the level of achievement of targeted consolidated performance indicators for the mid-term plan, and a fixed component, whereby a fixed number of the Company’s shares, etc. shall be delivered in accordance with the position.

- The performance indicators shall be (i) ROE and (ii) EBITDA as financial indicators, (iii) Relative TSR (vs TOPIX) as stock price indicator, (iv) GHG emissions per unit of sales and (v) Employee engagement as non-financial indicators.

Category Performance Indicators Reason for Selection Weight Financial Indicators ROE Important Performance Objectives for Long-term and Medium-term Plan Periods 30% EBITDA To improve cash generation capacity and profitability 30% Stock Price Indicator Relative TSR

(vs TOPIX)More profit sharing with shareholders 20% Non-Financial Indicators GHG Emissions per unit of sales Aiming to contribute to the realization of a sustainable global environment 10% Employee Engagement Aiming for the growth of the company through the growth of each employee and the exercise of his or her abilities. 10% - In principle, the “performance-linked component” shall vary between 0 to 200% of the standard payment amount, depending on the degree of achievement of the targets for each indicator, and shall be determined by a resolution of the Board of Directors after deliberation by the Compensation Committee. The degree of target achievement shall be calculated as follows.

- Financial indicators: Calculated by weighting the degree of achievement against targets for each fiscal year of the mid-term plan, by a predetermined ratio (*6).

- Stock price and non-financial indicators: Calculated based on the degree of achievement against targets as of the end of the mid-term plan.

- (*6):25% for the first year, 25% for the next year, and 50% for the final year

- Directors and officers shall continue to hold the Company's shares acquired through this plan until they retire from the Company.

- Bonuses

- Compensation Level

The Compensation Committee verifies the level of compensation for the Company’s officers by analyzing compensation data of major manufacturing companies obtained from the data compiled by a third-party organization and comparing the said data with the Company’s compensation level.

- Basic Philosophy on Compensation System

- Compensation Determination Method

The Compensation Committee is a voluntary advisory committee chaired by an Outside Director; the majority of whose members are Outside Directors. It deliberates on matters such as the compensation system and the level of compensation of Directors and Executive Officers, based on “(1)Basic Philosophy on Compensation System”, and makes proposals for a resolution of the Board of Directors. Compensation of Directors shall be resolved at the Board of Directors, within the maximum amount of compensation (total amount) approved at a general meeting of shareholders. The Compensation Committee also verifies the results of compensation payments. Likewise, compensation for Audit & Supervisory Board Members shall be determined through discussions among Audit & Supervisory Board Members, within the maximum amount of compensation (total amount) approved at a general meeting of shareholders. Through such procedures, the Company enhances the objectivity and the transparency of the compensation determination process.

- The Policy Determination Method

The establishment, revision and abolishment of this Policy shall be subject to a resolution of the Board of Directors following the deliberation and proposal by the Compensation Committee.

Corporate Policy over Internal Control and Operations of Internal Control

The contents of the Board of Directors’ resolution on the corporate policy over internal control and the overview of operations of internal control are as follows.

【Corporate Policy over Internal Control】

The Group Philosophy “Look Beyond” of the AGC Group provides that all members of the AGC Group are expected to adopt and follow the four shared values of “Innovation & Operational Excellence”, “Sustainability for a Blue Planet”, “One Team with Diversity” and “Integrity & Trust”, which shall serve as the basis for every action they take.

In addition to the above, the AGC Group declares its corporate social responsibility in the form of “AGC Group Charter of Corporate Behavior”, which is intended to lead the group members properly toward realization of the Group Philosophy “Look Beyond.”

The system to ensure the properness of operations is as follows.

- System to ensure compliance with relevant laws and the Articles of Incorporation (Compliance Program)

- The AGC Group defines “Integrity & Trust” as one of the most important shared values in its Group Philosophy “Look Beyond” and establishes and strengthens its compliance program based thereon.

- More specifically, the AGC Group has established the position of CCO (Chief Compliance Officer), responsible for the overall management and promotion of the AGC Group’s compliance system, which is served by an executive officer to whom the President & CEO of the Company (hereinafter referred to as the President & CEO) delegates its authority. In addition to this, the Company establishes the Compliance Committee responsible for legal and ethical compliance under the CCO. Chaired by a Global Compliance Leader (Executive Officer in charge), this Committee shall serve as a professional body for legal compliance and corporate ethics. It shall plan, formulate and execute a compliance program. It shall establish global common compliance rules and country/region specific rules in the Code of Conduct (AGG Group Code of Conduct) and establish the compliance system at the AGC Group, as well as promote educational activities in order to ensure business conduct based on laws and corporate ethics.

- In order to handle whistle-blowing and consultation on compliance, the AGC Group has set up contact points (compliance hotline). All the corporate officers and employees of the Company and executives of subsidiaries are obligated to submit the personal certificate.

- Actual status of compliance and usage of whistle-blowing and consultation system on compliance of the AGC Group shall be reported to the Board of Directors of the Company (hereinafter referred to as the Board of Directors) periodically.

- The Company shall also establish a legal administration system of the AGC Group to grasp information on important legal issues, which shall be reported to the Board of Directors periodically.

- With regard to internal audit of the AGC Group, the Internal Audit Division and the internal audit staff in each region shall audit managerial and operational systems as well as the legality and rationality of execution of business processes, pursuant to an annual auditing plan. Results of such internal audits shall be timely reported to the President & CEO and further to the Board of Directors periodically.

- In accordance with “Financial Instruments and Exchange Act” in Japan, the AGC group shall 40 establish “AGC Group Internal Control over Financial Reporting Implementation Regulations” and form the compliance system for financial reporting.

- Information Retention and Management System with respect to business operations of the AGC Group (Information retention/management system)

- Retention and management of important business documents and information shall be made pursuant to the applicable laws and the relevant internal rules of the AGC Group.

- Confidentiality and security of important business documents and information shall be maintained in accordance with the applicable procedures provided in the Information Security Policy to be made available through the Company.

- System to control risk of damage of the AGC Group (Risk management system)

- The AGC Group shall establish “AGC Group Enterprise Risk Management Basic Policies” and form the risk management system and crisis management system.

- According to the relevant internal rules, important risk factors for the AGC Group shall be specified, and control of these factors shall be discussed and monitored periodically at the Management Committee of the Company (hereinafter referred to as the Management Committee) and the Board of Directors. As for the risks associated with business activities of the AGC Group, each Corporate Division, in-house Company and SBU analyzes the risks of individual operations and projects and discusses necessary countermeasures. If necessary and appropriate, the Management Committee and the Board of Directors deliberate on such matters as well.

- Each responsible division provides and announces a respective guideline over those risks associated with compliance, environment, accidents and product quality etc. of the AGC Group and conducts training sessions and/or internal audits if necessary and appropriate.

- Preparing for unforeseen events that could seriously affect both the operating results and financial condition of the AGC Group, in accordance with the relevant internal rules, a crisis management report line has been established so that critical information can be reported speedily and surely to the President & CEO, and further distributed and shared among the officers and the employees concerned. The Company shall establish the system where the Group Taskforce Headquarters can be set up immediately upon the President & CEO’s judgment, in order to take initial measures without delay and appropriately.

- System to ensure efficient and effective business execution of the AGC Group (System for efficient business operation)

- As a basic policy over the corporate governance structure, the Company clearly distinguishes management oversight function and business execution function, aiming at realization of reinforced business oversight and quick decision making for business execution.

- As to management oversight, in the Company the Board of Directors including independent directors shall decide on the important business matters and oversee the business performance of the AGC Group. In addition, the Nominating Committee and the Compensation Committee (both nonstatutory) are established in order to warrant objectivity of evaluation/selection and compensation package with respect to Directors and Executive Officers of the Company.

- Authorities and duties with respect to business execution are delegated to each in-house Company and SBU in accordance with a certain standard under the in-house Company System and the Executive Officer System in the Company. These business operations are managed and evaluated in accordance with a specific consolidated key performance index established in line with the AGC Group’s basic management policy and its performance target.

- Business transactions in the AGC Group shall be conducted in accordance with the internal decision making rules including business authorization rules and job descriptions. These operations shall be monitored and verified by internal audit periodically.

- System to report matters concerning business execution of executives of subsidiaries to the Company (System for reports to AGC by AGC Group companies)

- Subsidiaries shall report certain matters concerning business operations, etc. to the Company. Of such matters, important ones shall be reported to the Management Committee and/or the Board of Directors.

- Under the compliance system and legal administration system of the AGC Group, subsidiaries shall quickly report any important compliance issue, important legal issue, etc. of the subsidiaries to the Company. These matters shall be reported to the Board of Directors periodically.

- The internal audit division shall timely report the results of internal audit conducted over subsidiaries to the President & CEO and further to the Board of Directors periodically.

- Matters related to the audit system of the Audit & Supervisory Board Members

- Staff to the Audit & Supervisory Board Members

- The Company establishes the Staff Office of the Audit & Supervisory Board to support the Audit & Supervisory Board Members activities

- Independence of the said Staff from Directors

- Change of staff members of the Staff Office of the Audit & Supervisory Board and performance evaluation of such staff members shall be subject to the consent of the Audit & Supervisory Board.

- Ensuring of effectiveness of Audit & Supervisory Board Members’ directions to the said Staff

- Staff members of the Staff Office of the Audit & Supervisory Board shall not concurrently serve as employees of other departments. Such staff members shall exclusively perform duties related to the Audit & Supervisory Board and follow directions of the Audit & Supervisory Board Members.

- System for reports to the Audit & Supervisory Board Members by Directors and employees of the Company, Directors and employees of subsidiaries, or those who received report from them

- The Directors and employees of the Company shall report to the Audit & Supervisory Board Members any event that may violate the laws and regulations or articles of incorporation of the Company, or do substantial damage to the Company, and other matters provided in the relevant internal rules.

- Subsidiaries shall report to the Company any event that may violate the laws and regulations or articles of incorporation of the Company, or do substantial damage to the Company. Divisions to which these matters are reported shall quickly report them to the Audit & Supervisory Board Members of the Company.

- System to ensure that those who made reports described in the preceding item shall not receive disadvantageous treatments on the ground that they made the said report

- The AGC Group shall ban disadvantageous treatments and retaliatory action against those who made reports concerning the violation of the Code of Conduct, etc. under the AGC Group Code of Conduct, and keep employees of the AGC Group well informed.

- Matters related to policy on procedures for reimbursement of expenses that occurred from performance of duties of the Audit & Supervisory Board Members

- The Company shall quickly handle expenses paid by the Audit & Supervisory Board Members, excluding cases where the said expenses are judged to be unnecessary for performance of duties of the Audit & Supervisory Board Members.

- Other system to ensure effective audit by the Audit & Supervisory Board Members

- The Audit & Supervisory Board Members shall attend important meetings such as the Management Committee, the Mid-Term Plan & Budget Committee, and the Monthly Performance Monitoring Meeting etc.

- In addition, Representative Directors shall have periodical meetings with the Audit & Supervisory Board Members. Meetings between the Audit & Supervisory Board Members and Internal Audit Division etc. shall be held periodically so that the Audit & Supervisory Board Members may have access to information in respect of the results and the proceedings of internal audits. The Company establishes the system where the Audit & Supervisory Board Members may enhance effectiveness of its audits through exchange of views and information with the Internal Audit Division and the Accounting Auditors, etc.

- Staff to the Audit & Supervisory Board Members