Business Risks

1.Risk Management System

In 2023, the AGC Group carried out a comprehensive overhaul of the classification of key risks for the purpose of managing risks in accordance with their characteristics. The Group has grouped itsrisks into the following seven categories, as shown in the table below.

| Category | Examples of risk |

|---|---|

| Strategy | Various individual risks related to business management, such as changes in market environment, competitive advantage, new business exploration and investment, and geopolitical and country risks |

| Operation | Procurement risks due to supply chain issues Business suspension and compensation risks due to violation of environment and safety-related laws and occupational accidents Risks associated with violations of laws, ordinances and regulations regarding product quality and customer requirements |

| Compliance | Risks of administrative sanctions and business suspension arising from antitrust law, bribery, and security trade control Risk of loss of trust due to intentional tampering with quality and environmental data Risk of loss of trust due to improper accounting or window dressing |

| Sustainability | Risk of erosion of trust and suspension of transactions due to the inability to deal with requests regarding climate change, respect for human rights, and related issues |

| Natural disasters and infectious diseases | Business interruption risk due to natural disasters such as large-scale earthquake and storm damage, outbreak of an unknown virus, or pandemic |

| Cybersecurity and information security | Risk of information leak or business interruption due to cyberattack Risk of information leak due to reasons other than cyberattack |

| Financial | Risk related to the reliability of financial reporting, as well as financing and fund procurement |

In risk management, the Group has identified as key risks those risks that are expected to have a significant impact on the Group when they occur, considering the magnitude of the impact and the likelihood of occurrence, and is closely monitoring them.

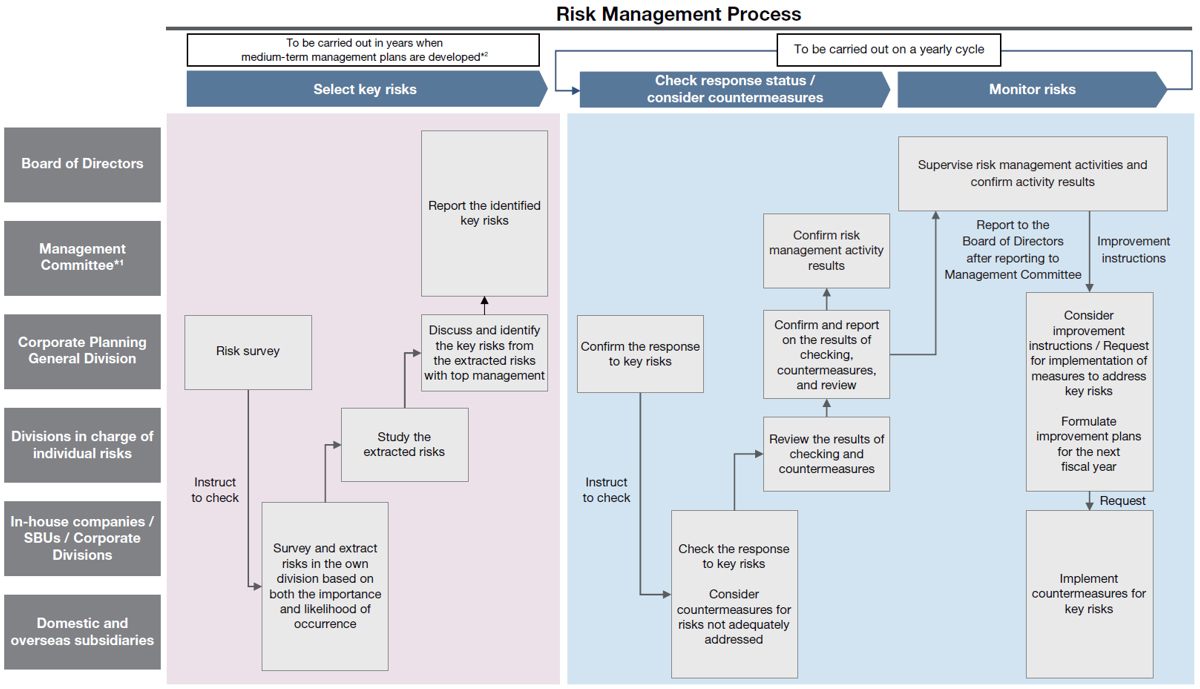

In the Strategy category, in-house companies, SBUs, and corporate divisions analyze risks and examine countermeasures for each business and project. If necessary, such risks are deliberated on by the Management Committee and the Board of Directors. Key risks are revised every year in order to respond rapidly to changes in the market environment and the factors that may impact risks.

For risks other than those in the Strategy category, the corporate division in charge of each risk establishes guidelines and related policies, as well as undertakes related activities such as familiarization, training, and auditing. In addition, the entire AGC Group conducts self-inspections, and the results are monitored by the Management Committee and the Board of Directors. Key risks are added when needed. Concurrently, key risks are revised in years when medium-term management plans are formulated, considering the magnitude of the risks’ impact and likelihood of occurrence.

*1 Including business strategy meetings and other meetings similar to Management Committee meetings *2 Revisions will be made as needed in accordance with changes in the business environment and other factors.

<Response to risks that have emerged>

In preparation for unforeseen events that could have a significant impact both on the operating results and financial condition of the AGC Group in accordance with the relevant internal rules, the Group has established a crisis management report line to report on critical information speedily and surely to the CEO, and to further distribute and share the information among officers and employees concerned under the “Bad News First” concept. In addition, the Group has a system where a Group task force can be set up immediately at the discretion of the President & CEO to ensure that a prompt and appropriate initial response can be taken.

2.Business risks

Risks associated with the Group’s operations and other risks that may materially influence investors’ decisions are stated in this section. However, this section does not include all possible risks relating to the Group; there may exist additional risks not stated below. Any such risks are also likely to influence investors’ decisions. Forward-looking statements in this section are based on information available as of March 28, 2024.

<Strategic risks>

- Geopolitical risk / country risk

The Group, in addition to its operations in Japan, has overseas operations, including exports and imports of products and manufacturing abroad. As risks associated with these global business activities, the Group is considered to face geopolitical and country risks including deteriorating political and economic conditions, the imposition of regulations on exports and imports and foreign investments, unexpected changes in laws and regulations, the worsening of public security, economic sanctions between countries, and the occurrence of social turmoil or other disruptions due to terrorist attacks, war, infectious diseases or other factors in the countries and regions where the Group operates. For its part, the Group carefully monitors factors such as political and economic conditions and regulatory trends in each country and region and strives to mount effective responses appropriate to the situation.

However, the occurrence of these events may hinder the Group’s overseas operations and have a serious effect on its performance and financial position. - Changes in the market environment

Demand for the Group’s products is impacted by market trends in industries such as construction and building materials, automobiles, electronics and displays, chemicals, and pharmaceuticals and agrochemicals. The Group’s products are supplied throughout the world, for example in Asia, the United States and Europe, as well as in Japan, and sales are therefore influenced by local economic conditions. Although the Group is working hard to build an earnings structure that is resilient to changes in the business environment by improving productivity and reducing fixed and variable costs, through falling sales volumes and prices, its performance and financial position are susceptible to declining demand from the industries as well as economic downturns in the regions where its products are primarily sold. - (ⅰ)Architectural Glass

In the Architectural Glass segment, the Group has established development and production bases in Japan/Asia, Europe and the Americas and supplies products throughout the world. Demand for architectural glass is correlated with construction investment, which varies with economic conditions in each region and country. Accordingly, earnings in this business could be impacted by fluctuations in demand for architectural glass. - (ⅱ)Automotive

In the Automotive segment, demand for automotive glass is influenced by automobile sales volume, which is correlated with factors such as economic fluctuations in each region and country. Accordingly, earnings in this business could be impacted by fluctuations in demand for automotive glass. - (ⅲ)Electronics

Products in the display business are used in LCD TVs, smartphones, and tablets, etc. In the LCD glass substrate business, changes in the market shares of panel manufacturers, which are the Group’s customers, shifts in market trends, and other developments are expected to occur. The Group has been working to expand sales based on its customer portfolio. Nonetheless, customer and market trends could have an impact on the profitability of the display business. In the electronic materials business, the Group’s main customers are companies involved in industries such as semiconductors and optoelectronics. The performance of these customers depends on market trends in areas such as semiconductors, smartphones, communications infrastructure and industrial equipment. For this reason, earnings in the electronic materials business could be influenced by the impact of these trends. - (ⅳ)Chemicals

In chlor-alkali products, the Group has established production bases primarily in Japan and Southeast Asia, where progress is being made on infrastructure development, and is expanding its business. Demand for these products is mainly correlated with economic growth rates and capacity utilization in core industries in each region and country. Accordingly, earnings in this business could be impacted by fluctuations in demand for chlor-alkali products. In the fluorochemicals & specialty business, the Group’s main customers are companies involved in transportation equipment, semiconductor and construction industries. Accordingly, earnings in the fluorochemicals & specialty business could be impacted by market trends in these industries. - (ⅴ)Life Science

In the life science business, the Group is greatly impacted by business conditions and the development status of new products in the pharmaceuticals and agrochemicals industries. Accordingly, earnings in the life science business could be impacted by these trends. - Risks related to competitive advantage

In every business in which the Group operates, there are competitors supplying products similar to those of the Group. Accordingly, to maintain its competitive edge relative to those competitors, the Group is striving to identify the needs of markets and customers, and to meet requests for quality, price, delivery and other factors, as well as develop new technologies and acquire intellectual property.

However, should the Group fail to appropriately respond to changes in those customer needs, develops new technologies too slowly, or intellectual property-related lawsuits and other legal proceedings occur, growth could be hampered and profitability could decline. This may significantly impact the AGC Group’s performance and financial position.

Currently, the Group is involved in some intellectual property-related lawsuits and other legal proceedings. If these lawsuits and legal proceedings result in a disadvantageous outcome for the Group, its performance and financial position may be significantly impacted. - Risks related to new business exploration and investment

The Group strives to explore new businesses, with the aim of ensuring short- and medium-term growth and enhancing profitability. The Group accomplishes this goal through investment-driven acquisitions of technologies and businesses. When engaging in new business exploration and investment, the Group strives to identify risks by undertaking profitability analysis and due diligence, considering a range of risks. However, if the environment changes or unforeseen risk factors materialize during the business development phase, the Group’s growth and profitability might be hindered.

This has the potential to significantly affect the Group’s performance and financial position.

<Operation risk>

- Supply chain

In cases where manufacturing is outsourced to subcontractors, the Group endeavors to secure multiple subcontractors from the perspective of business continuity.

However, given that some of the Group’s products cannot be replaced by alternatives, should production cease temporarily or for an extended period because of serious production disruptions and similar situations at the Group or the Group’s manufacturing subcontractors, the Group’s performance and financial position could be serious affected.

Additionally, as part of the Group’s production activities, the Group uses certain special raw materials, supplies and other resources for which suppliers are limited. The Group considers alternative materials and strives to promote the purchasing of such raw materials, supplies, and other resources from multiple suppliers.

However, if the supply of these materials tightens or is delayed, or price fluctuations occur, the Group’s performance and financial position may be greatly affected. - Environment, safety, and quality

The Group is making every effort to ensure that products are of the highest quality, according to their individual characteristics.

Despite these efforts, the possibility remains that quality problems may occur because of unanticipated factors, prompting a major recall, for example. If the Group is pursued for product liability, this could have a significant impact on its performance and financial position.

Additionally, the Group complies with all applicable laws and regulations related to the environment, while striving to protect the global environment by mitigating environmental impacts associated with business operations through such means as setting and implementing voluntary control standards that are more stringent than legal and regulatory benchmarks.Nevertheless, as an environmental regulation risk, the Group could find itself involved in unintended environmental pollution or other such incidents as a result of emissions from the Group’s manufacturing processes, chemical substances contained in its products, or other such causes.

Such a scenario could result in a deterioration in the Group’s social credibility, restrictions on business activity, incurring expenses, and other consequences, which could affect the Group’s profit and loss. Moreover, revised or strengthened regulations in each country or region may require the Group to bear additional costs or capital investment, or such regulations may hinder product development, production, sales, services and other business activities. In such a scenario, the Group’s profit and loss could be affected.

In the Chemicals segment, the Group manufactures and sells various fluorine-related products. Chemical substances that contain carbon and fluorine atoms (perfluoroalkyl compounds or polyfluoroalkyl compounds) are broadly and collectively referred to as PFAS. Although there are approximately 12,000 types of PFAS, only a few types of PFAS are currently targeted by the Stockholm Convention due to concerns about their negative impacts on the environment and human health. Among the three types of PFAS listed [as Persistent Organic Pollutants (POPs)] in the Stockholm Convention, the Group has never engaged in the production of PFOS and PFHxS and had already ceased the production and sale of PFOA in 2015, prior to PFOA having been targeted under the Stockholm Convention. Although each PFAS substance has distinct characteristics and different properties, the European Union and some states in the United States are proposing to regulate all PFAS collectively without distinguishing the various PFAS substances. Considering the significant role of fluorine-related products in many industries, the Group is making efforts, such as submitting public comments to the agency of European Union, to ensure that PFAS will be regulated to the appropriate extent by taking into account the properties of each PFAS substance based on sufficient scientific findings, even if certain restrictions are enforced on PFAS. The scope and details of regulations regarding PFAS are not finalized yet; however, the regulations which may be introduced could affect the Group’s performance.

Furthermore, the Group endeavors to prevent occupational accidents and other accidents involving equipment and facilities such as production machinery, through the establishment and operation of a systematic management system for the environment, industrial safety and security, and occupational safety and health, along with efforts to promote and ensure machinery safety and to manage inspections, maintenance and repairs.

However, unforeseeable events such as a severe occupational accident, serious fire, explosion or leakage incident may occur. In such a case, the Group’s profit and loss could be affected.

<Compliance risks>

- Government regulations

In the countries and regions where it operates, the Group is subject to the local government approval and authorization of investments, regulations on exports and imports, and laws and regulations governing commercial transactions, labor, patents, taxation, foreign exchange, and other issues. The Group closely monitors trends in amendments to relevant laws and regulations and strives to gather information. Despite these efforts, amendments to relevant laws and regulations may significantly influence the Group’s performance and financial position. - Litigation and legal procedures

There is always a risk that lawsuits and other legal proceedings may be taken against the Group with respect to its operations at home and abroad. Currently, the Group is involved in some lawsuits and other legal proceedings. If these lawsuits and proceedings result in an unfavorable outcome for the Group, its performance and financial position may be significantly impacted.

In the United States, multiple lawsuits have been filed by individuals, local governments, and others against fluorine-based fire-fighting foam manufacturers and fluorine chemical manufacturers, including the Group, alleging environmental and health impacts caused by products, such as fire-fighting foams, that contain PFAS. Although it is not possible to predict the outcomes of these lawsuits, if the outcomes turn out unfavorable for the Group, its performance and financial position may be affected.

The Group is appropriately addressing these lawsuits with the assistance of outside legal counsel.

<Sustainability risks>

The Group is pushing ahead with sustainability management with the goals of contributing to its long-term growth and realizing a sustainable society. For long-term social issues (material issues), which will be crucial to advancing sustainability management, the Group has identified the five key risks listed below, along with major opportunities. Certain risks that may materialize in the short and medium term will be managed through integrated risk management. Additionally, the Sustainability Committee, which was established under the supervision of the Board of Directors, is in charge of risk management for the principal key risks. The Sustainability Committee makes decisions on countermeasures and deliberates on initiatives.

- Responding to climate change issues

Since the Paris Agreement was reached in 2015, the trend toward decarbonization has been accelerating, and energy-related policies, and laws and regulations are expected to become stricter, while social demands for companies to achieve net zero greenhouse gas emissions are increasing. With this risk in mind, the Group has set its vision for 2050 to “aim for net zero emissions from our own business activities (Scope 1, 2).” Concurrently, it has established a goal to “contribute to the realization of net zero carbon worldwide through our products and technologies.” To realize its vision for 2050, the Group will strive to implement measures to reduce greenhouse gases according to the sources of emissions, such as the development of manufacturing technologies and facilities with low greenhouse gas emissions. At the same time, the Group will take this item as a major opportunity to expand sales of products that save or generate energy throughout their life cycle, and to build business models that contribute to the spread of renewable energy.

However, if carbon pricing such as a carbon tax which has begun to be implemented in some areas is required to be implemented on a full scale, the cost burden required to comply with these regulations and other rules may have an impact on the Group’s profit and loss. Additionally, the Group may potentially be subject to opportunity loss due to deterioration of its reputation or social credibility if it is unable to address increasingly stringent regulations in each country and geographical region for conforming to regulations on greenhouse gas emissions and otherwise addressing climate change; it is unable to achieve targets for reducing greenhouse gas emissions in alignment with the Paris Agreement; or it is unable to address mounting stakeholder demands for the Group to contribute to decarbonization through its business activities. - Effective use of resources

Stricter regulations on the use of depletable resources such as rare earth materials and increased demand for water resources due to the progress of urbanization are expected to have an impact on manufacturing activities. At the same time, social demand for waste reduction and recycling is increasing as the recycling-oriented economy accelerates. The Group is striving to utilize recycled raw materials and materials, as well as reduce the amount of landfill disposal. It considers this item as a major opportunity to expand sales of products that contribute to the purification of groundwater and rainwater in water-scarce areas, develop products and manufacturing processes that use less depletable resources, and expand sales of products that are highly recyclable and reusable.

However, if the trend toward developing standards and legislation for recycling-oriented economic systems advance faster than anticipated, the Group may be unable to adequately meet demand for waste reduction and recycling. Such a scenario could lead to opportunity losses in the market. - Supply chain considering society and the environment

As supply chains become more globalized and complex, it may be expected that illegal employment issues, such as forced labor and child labor, will occur at suppliers and subcontractors, as well as operational stoppages, regulatory violations, and related issues due to stricter environmental regulations. With this risk in mind, the Group has established the AGC Group Human Rights Policy and the AGC Group Purchasing Policy, which stipulates sustainable procurement and other measures to reduce environmental impact. Moreover, the Group will work to add value to the entire supply chain. It announced the Partnership Declaration, which aims to build co-existence and co-prosperity with suppliers through collaboration that transcends existing business relationships and corporate scale. The Group will strive to manage suppliers with an emphasis on respect for human rights and environmental protection. - Ensuring fair and equal employment and workplace safety

There is a growing need for compliance in employment and respect for workers’ rights, as well as a need for safety measures at manufacturing sites due to the increasing number of inexperienced and elderly workers. With this risk in mind, the Group will strive to improve employee engagement and prevent the occurrence of serious and lost-time injuries. - Relationship with local communities and environmental considerations

There is growing interest in the expansion of living areas and the maintenance of the surrounding biodiversity due to the spread of urbanization around the world, as well as a growing awareness of the need to improve quality of life (QOL) as living standards improve in emerging countries. With this risk in mind, the Group will strive to reduce water consumption, conserve biodiversity, and eliminate environmental accidents, as well as build good relationships with the areas where its work sites are located.

<Risk of natural disasters and infectious diseases>

In preparation for the occurrence of natural disasters, infectious diseases or other such events, the Group has assessed the risks concerning earthquakes, high winds, flooding, infectious diseases, and other such events at its major bases, and has drawn up business continuity plans for bases that are exposed to significant hazards.

Despite these efforts, the Group faces the risk of unforeseen events such as the interruption of business activities, damage to production facilities, suspension of product shipments due to severed transportation networks, as a result of natural disasters such as major earthquakes, typhoons, and floods as well as unknown infectious diseases that may exceed what is anticipated by the business continuity plans. If production is suspended temporarily or for an extended period in the Group or the Group’s supply chain as a result of the occurrence of such unforeseen events, the supply of products to customers may be disrupted given that alternative production is not possible for certain products, and this could have an impact on the Group’s performance and financial position.

<Cybersecurity and information security risk>

Information security threats continue to increase as a result of temporary operational stoppages or the leakage of information assets caused by cyberattacks, or natural disasters, unauthorized access, and other unforeseen situations. The Group strives to protect its information assets, such as IT systems, manufacturing systems, and data. Moreover, the Group implements measures to prevent security incidents and measures to minimize the impact of such incidents when they occur.

However, if important operations are interrupted or confidential data is leaked and so forth due to a cyberattack, natural disaster, unauthorized access, or other such unforeseen situation, this may have a significant impact on the Group’s performance and financial position.

<Financial risks>

- Rising raw material and fuel prices

If there are fluctuations in the prices of electricity, fuel gas, heavy oil or raw materials used in the Group’s production activities, the Group’s performance and financial position could be affected. The Group hedges the risk of price fluctuations for certain raw materials and fuel through instruments such as commodity contracts. Nevertheless, the Group may be unable to completely eliminate the impact of rising raw material and fuel prices. - Exchange rate fluctuations

The Group manufactures and sells products worldwide, and converts transaction accounts in local currencies, including sales, costs, and assets, into Japanese yen when preparing its consolidated financial statements. Even if the values of these items remain unchanged in local currency terms, they may change when converted into Japanese yen depending on exchange rates.

The Group also manufactures products at its facilities worldwide, including Japan, and exports the products to a number of countries. The Group generally procures raw materials and sells products in the local currency of each country/region, but there are some product sales and material purchases denominated in foreign currencies. Accordingly, fluctuations in exchange rates influence the prices of materials the Group procures and the pricing for its products. The Group implements measures such as hedge transactions to address short-term exchange rate fluctuations, along with striving to reduce risk through steps such as conducting production from production bases located globally. Despite these efforts, the Group’s performance and financial position could be impacted heavily as a result of large movements in exchange rates. - Retirement benefit obligations

The Group calculates costs for employee retirement benefits and obligations based on actuarial assumptions of the returns on pension funds and a specific discount rate. If the actuarial assumptions and results diverge substantially because of deterioration in the market environment for pension fund management, future costs for retirement benefits will increase, and this may seriously impact the Group’s performance and financial position. - Impairment of non-financial assets

Non-financial assets including property, plant and equipment, goodwill and intangible assets reported on the Group’s consolidated statements of financial position may become subject to impairment loss if a recoverable amount of any such asset has fallen below the carrying amount due to lower profitability, changes in fair value, or other such circumstances going forward. Such a scenario could significantly affect the Group’s performance and financial position. In particular, in the display business, which is included in the Electronics segment, the Group has recognized a deterioration in operating profitability primarily due to the impact of a slow recovery in demand for LCD glass substrates and the increased cost caused by the weaker yen and the soaring raw materials and fuel prices, which resulted in an indication of impairment for the cash-generating unit to which the relevant non-financial assets belong. In addition, the Group recognized a deterioration in operating profitability at AGC Biologics, Inc., which is a contract development and manufacturing organization (CDMO), offering biologically active pharmaceutical ingredient (API) and gene and cell therapy pharmaceutica manufacturing services, and is included in the life science segment. The deteriorating operating profitability was primarily due to a temporary downturn in demand across the market as a whole due to a decrease in inflows of funds to biotech startups and delays in the launch of new lines, resulting in an indication of impairment for the cash-generating unit to which the relevant non-financial assets belong. The Group has performed impairment tests for each cash-generating unit. As a result, since the recoverable amount calculated based on the value in use was above the carrying amount of each cash-generating unit, the Group did not recognize impairment losses. However, it may be impacted in the future by economic and other conditions in the market.