Medium-Term Management PlanAGC plus-2026

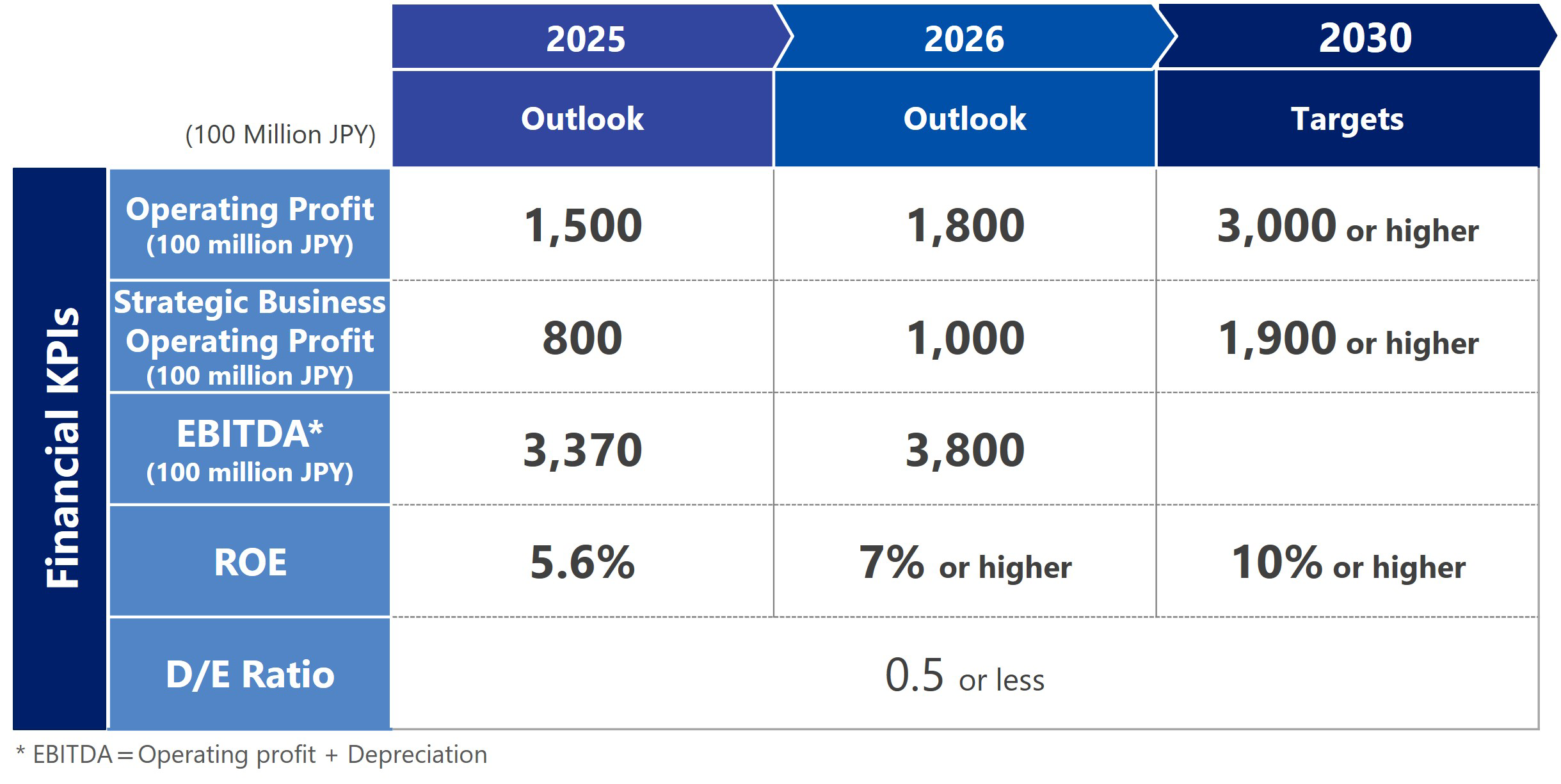

AGC has formulated a new medium-term management plan, AGC plus-2026, as a framework for continuing steady progress under its long-term strategy, Vision 2030. Our key strategies and financial targets under this plan are as follows.

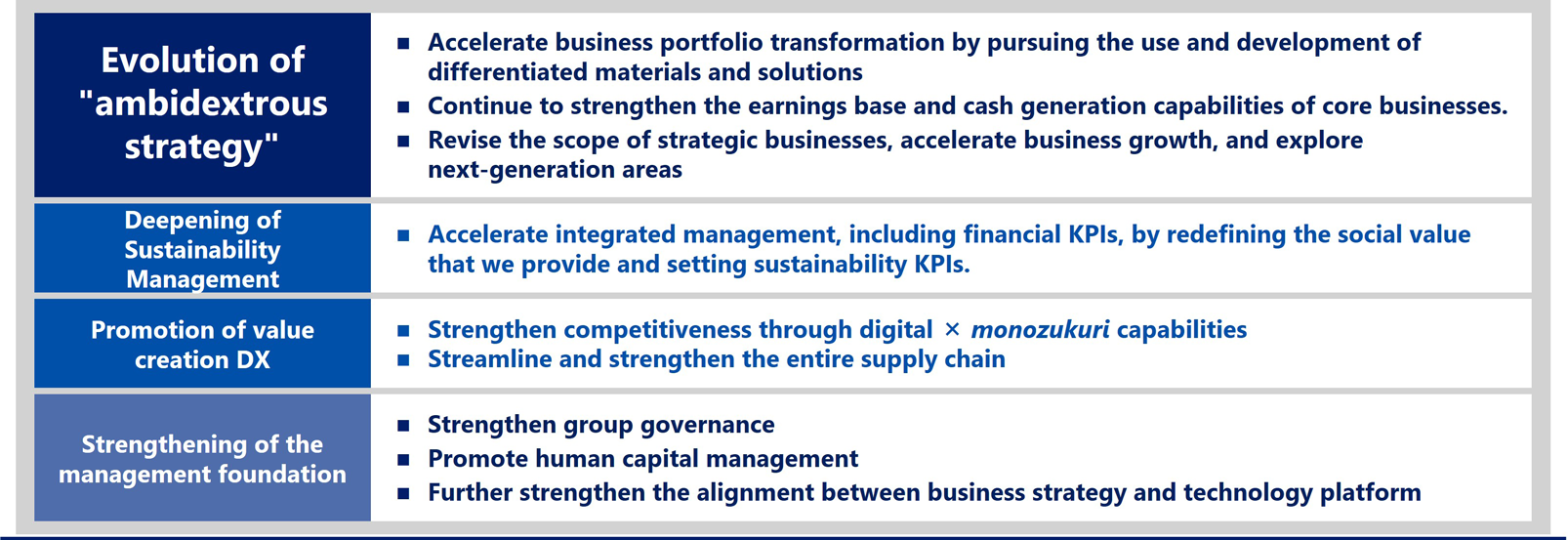

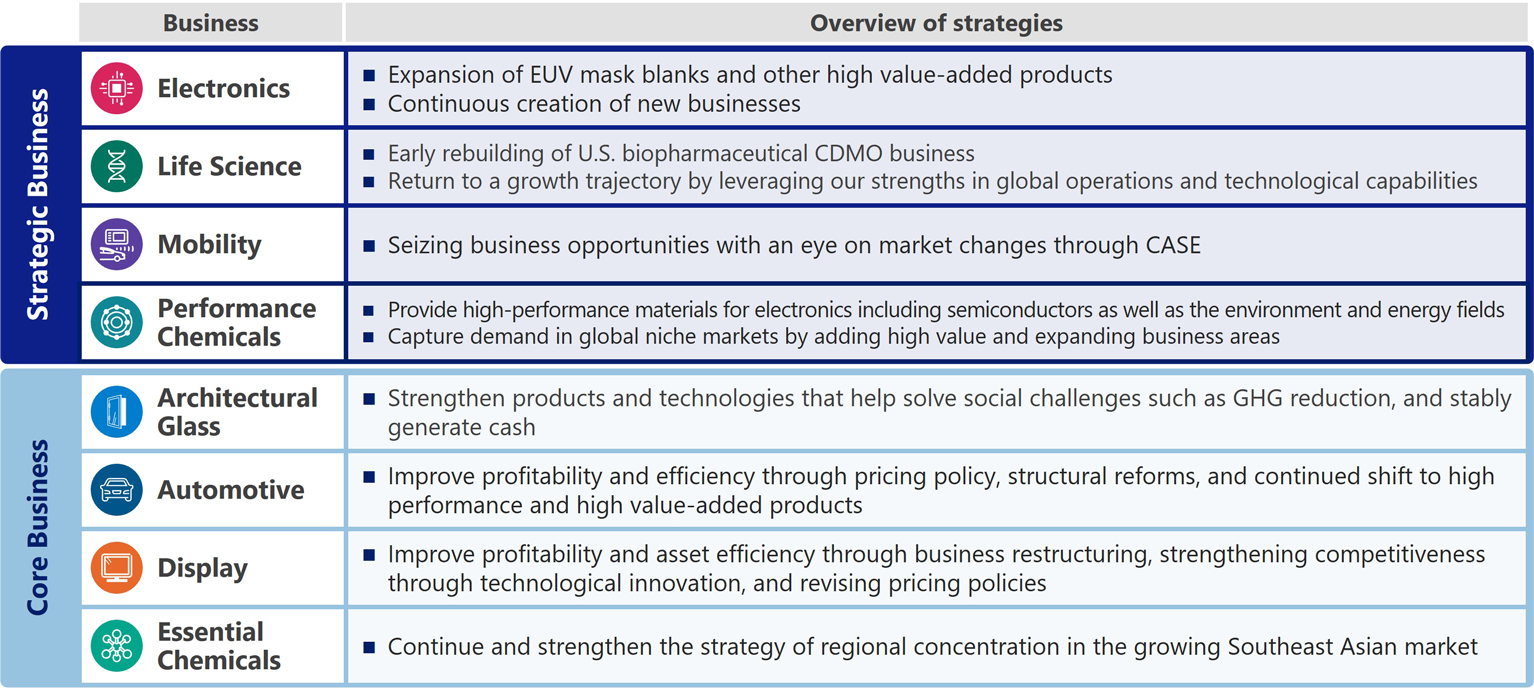

Key strategies

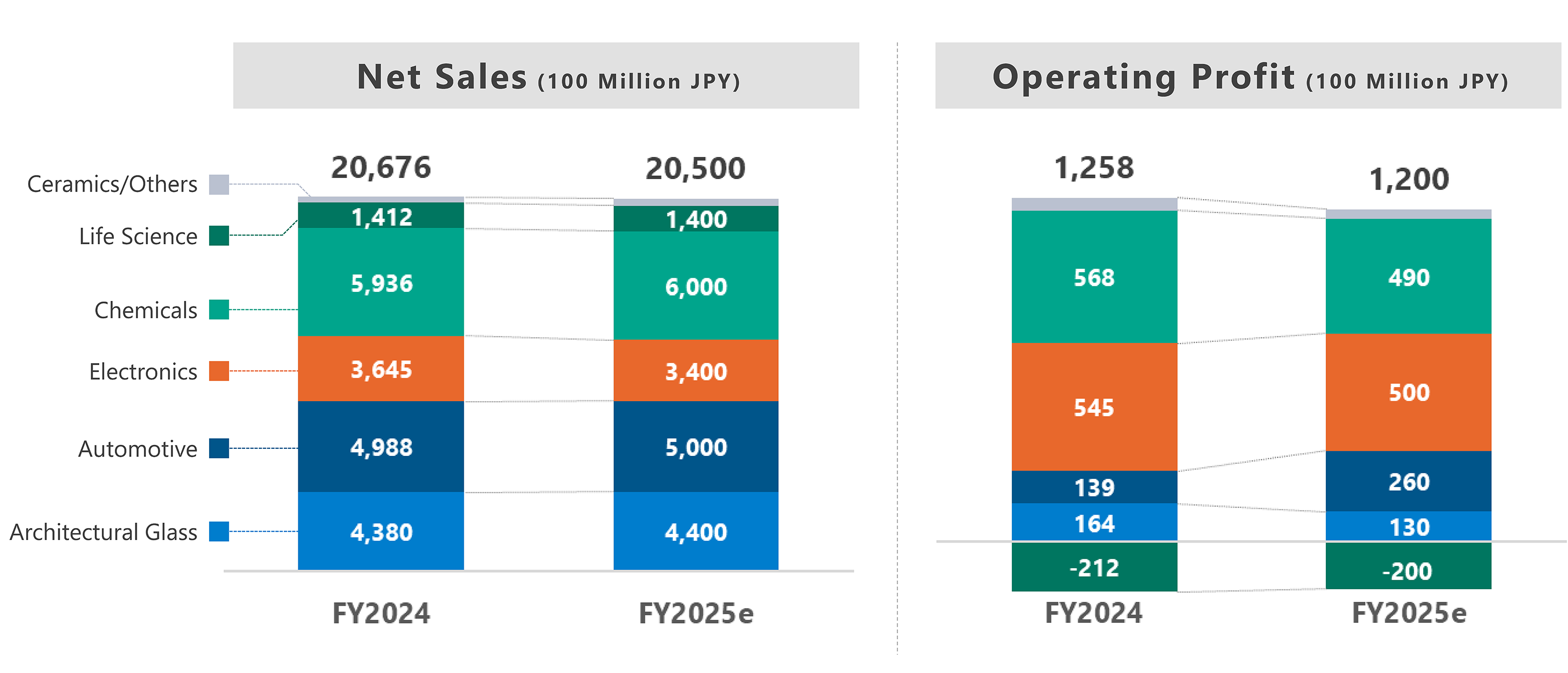

Financial targets and the latest financial results

Operating profit of strategic businesses

- Q1. What is the evolution of "ambidextrous strategy"?

- A1. Through the business management with its unique ambidextrous approach, the AGC Group will continue to aim at building a business portfolio that is resilient to market fluctuations and has high asset efficiency, growth potential, and carbon efficiency.

Our key priorities for each business under AGC plus-2026 are outlined below.

Through these initiatives, the AGC Group aims to achieve a Group-wide ROCE (return on capital employed) of 10% or higher, operating profit of 180 billion Japanese yen by 2026, the final year of the plan.

- Q2. What is the deepening of sustainability management?

- A2. Accelerate integrated management, including financial KPIs, by redefining the social value that we provide and setting sustainability KPIs.

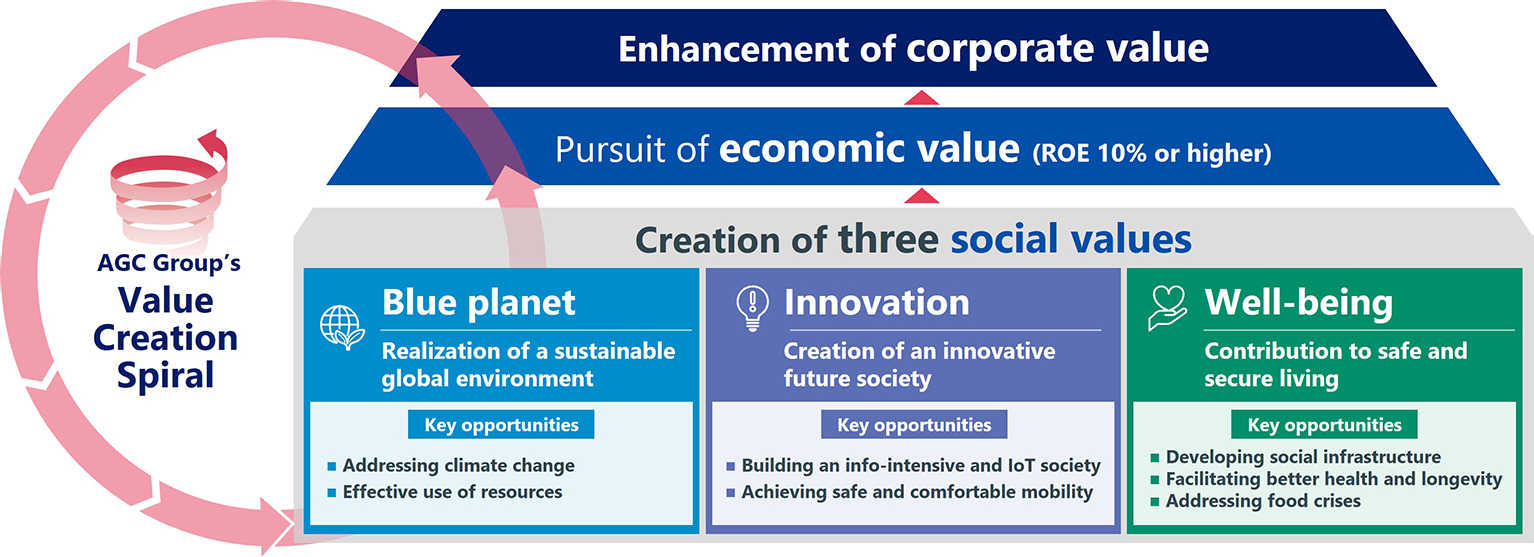

In formulating AGC plus-2026, the AGC Group has reclarified the values that it will contribute to society, by replacing the existing "five social values" with "three social values" to be created by the Group’s products and technologies.

The AGC Group will create economic value through the creation of these three social values and achieve an upward spiral of enhanced corporate value.

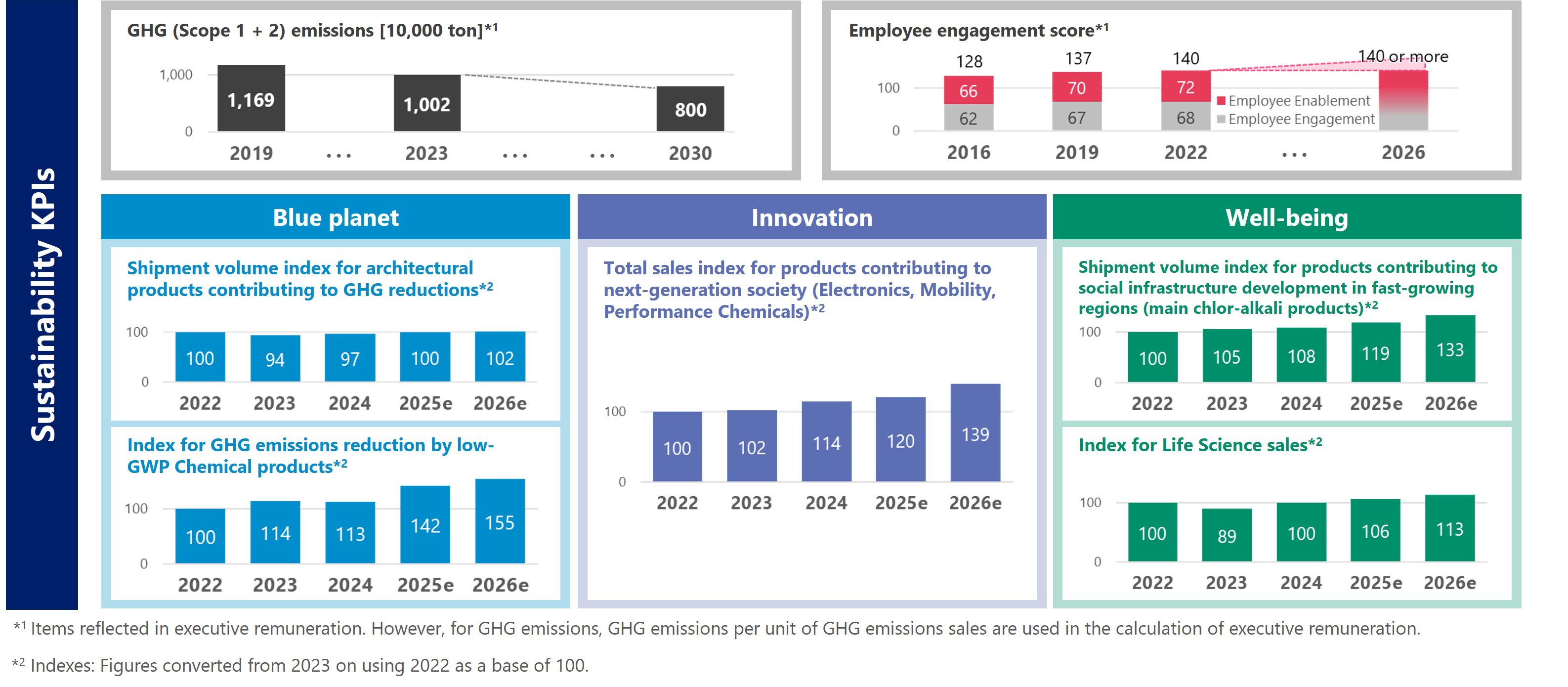

In order to integrate a sustainability perspective into its overall management and to monitor its implementation, the AGC Group has decided to include GHG emissions per unit of sales and employee engagement scores as indexes in the calculation of stock compensation for its directors and executive officers. In addition, the Group has established sustainability KPIs related to the three newly defined social values.

- Q3. What is the promotion of value creation DX?

-

A3.

Under

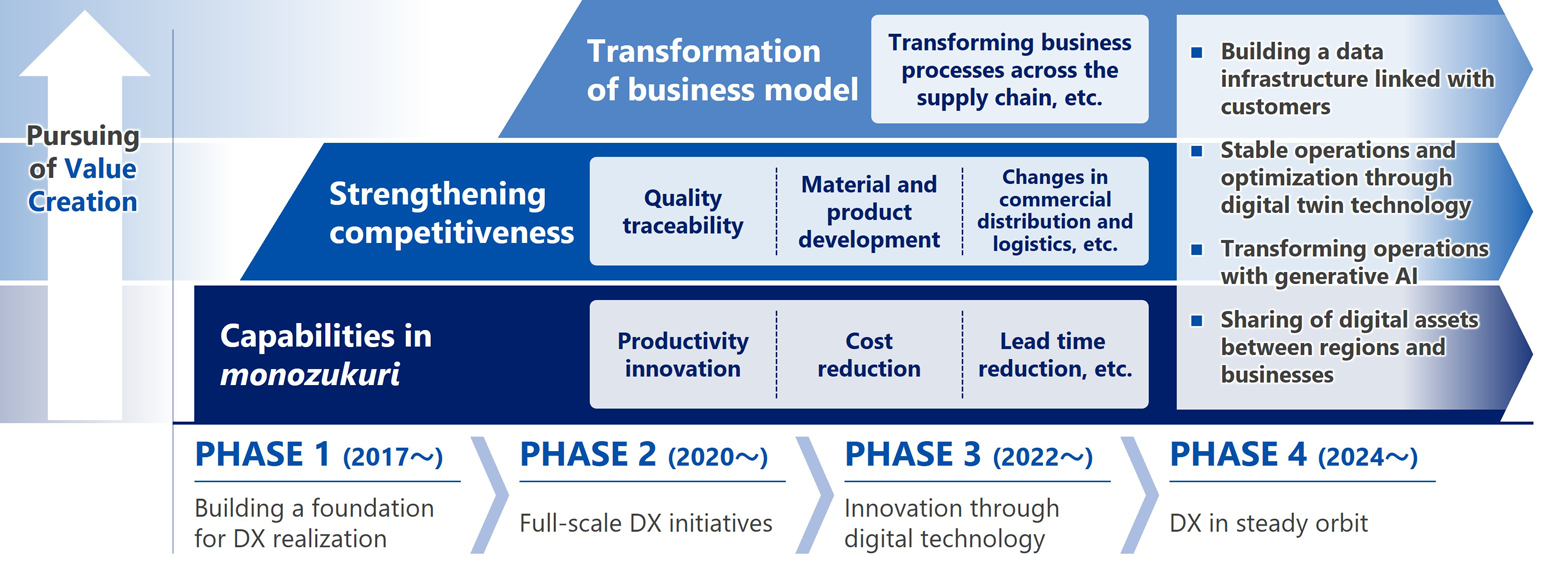

, the AGC Group will enhance the competitiveness of each business by combining the digital technology it has cultivated since 2017 with the AGC Group’s capabilities in monozukuri.

, the AGC Group will enhance the competitiveness of each business by combining the digital technology it has cultivated since 2017 with the AGC Group’s capabilities in monozukuri.

In 2017, the AGC Group began building a foundation for the realization of DX, including the digitization of data, and has since strengthened its capabilities in monozukuri by reducing costs and lead times in existing businesses. Starting in 2020, the Group has been implementing DX initiatives leveraging this foundation and is currently creating and delivering new value through business model reforms, such as transforming business processes across the supply chain.

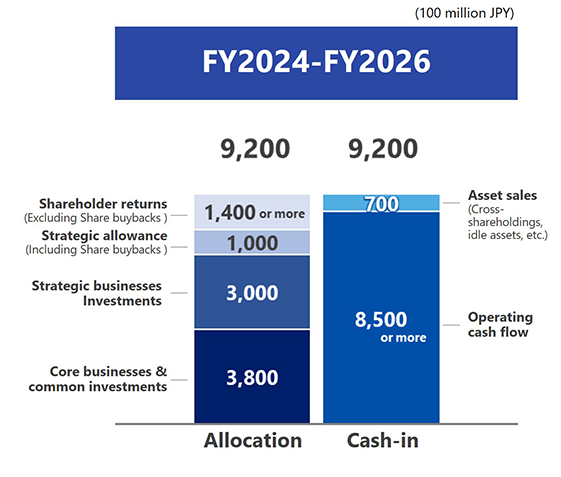

- Q4. What is your policy on the allocation of capital?

- A4. The AGC Group plans to actively invest in strategic and growth businesses. Regarding shareholder returns, the Group will continue to maintain stable dividends with a target of approximately 3% Dividend on Equity.

In order to continue proactive investments in strategic and growth businesses, the AGC Group has established a strategic allowance of 100 billion Japanese yen. Regarding shareholder returns, the Group will continue to maintain stable dividends with a target of approximately 3% Dividend on Equity. The AGC Group will comprehensively determine the optimal allocation of capital, including the acquisition of treasury shares, taking into account investment projects and cash flow, etc., within this strategic framework.

The capital allocation policy for AGC plus-2026 based on the above business plan, investment plan, and shareholder return policy is as follows.