Mastering ‘ambidextrous strategy’ Navigating success via strategic business exploration and exploitation

- #Management Strategies

- #Spirit

- #Collaboration

“Ambidextrous strategy” entails balancing two contrasting business strategies: exploration that involves seeking and embracing new opportunities, technologies, ideas and markets; and exploitation with a focus on optimizing existing processes, products, services and resources. Renowned Stanford Business School professor Charles A. O'Reilly once lauded AGC for its embrace of ambidextrous strategy. What does it take for management to achieve this skill? CEO Hirai discussed this with Professor Iriyama, the earliest proponent of this concept in Japan.

Profile

Akie Iriyama

Waseda Business School Professor

Yoshinori Hirai

Representative Director, President and CEO AGC Inc.

Iriyama Ambidextrous strategy has only started gaining traction in the Japanese business community. But this “ambidexterity” is already well known among scholars in the field. Ten years ago I introduced the concept in my book, and it gradually gained recognition. Later, when I translated a book by Charles A. O'Reilly, a professor at Stanford Graduate School of Business and a leading expert in this field, I coined a Japanese term for the concept and used it for the book’s title. In his book, O'Reilly mentioned AGC as a company that has traditionally striven for ambidextrous strategy. Personally, I share his interest in AGC and how large, traditional Japanese corporations have pursued ambidexterity in their business initiatives.

Akie Iriyama Waseda Business School Professor

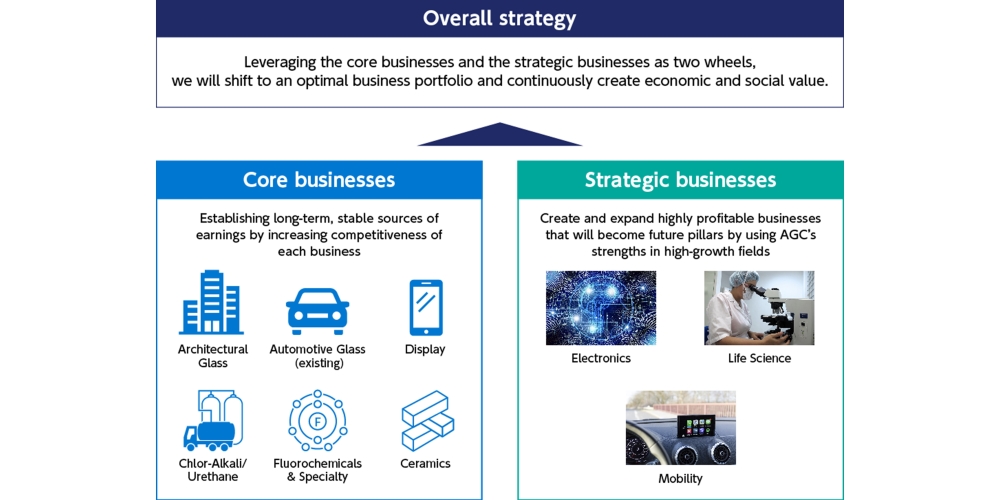

Hirai AGC established itself as the first Japanese manufacturer of architectural glass. Over time, we diversified into automotive, television and LCD panel glass, and further expanded into the fields of chemicals and life sciences. I believe few other glass manufacturers have diversified to this extent. O'Reilly refers to this approach as “ambidextrous.” Currently, we are optimizing our business portfolio by specifying architectural and automotive glass, as well as chemical products, as our core businesses. Simultaneously, we are positioning new ventures in mobility, electronics and life sciences as strategic businesses. The two approaches underlie our current business model.

Meeting Professor O'Reilly in 2018 made me realize that our approach closely aligns with his concept of ambidextrous strategy. It's crucial for older, traditional companies like ours to adopt this approach when we pursue new directions. However, what sounds good in theory can be challenging in practice.

Ambidextrous strategy at AGC

Iriyama Management science is not about providing companies with brand new perspectives, but rather decoding and articulating the essence of successful management worldwide, then transforming findings into theory that many can reference and ultimately benefit from.

Hirai Indeed, the concept of ambidextrous strategy helped us more clearly see and reorganize the previously ambiguous aspects of our business.

The success of a new venture hinges on support from existing business resources. This involves strategically moving top talent from a successful venture to the new one, despite potential resistance from entrenched managers. Selecting the right resources can markedly boost chances for the new venture's success.

Yoshinori Hirai Representative Director, President and CEO AGC Inc.

Iriyama In times of success, companies often lack a sense of urgency and resist change. However, when performance declines, anxiety arises, resulting in a push for transformation. How about your experiences at AGC?

Hirai In terms of crisis, there was indeed a significant turning point. In 2010, we achieved record-breaking profits based on operating income. However, nearly 80% of those profits came from a single business segment -- glass substrates for liquid crystal displays (LCDs). At that time, I was in charge of launching new ventures. One day top management asked me how many more years of momentum was left in this sector. I replied it might be about three years. Indeed, four years later, operating profit in the sector for LCD glass substrates plunged 75%.

Depending too much on a single core business can lead the entire company into crisis if the core business tanks. In response to a significant profit drop, then-CEO Takuya Shimamura (now chairman) emphasized the need to return to our roots.

We have consistently embraced innovation during industry paradigm shifts, an attitude that embodies the essence of AGC. Returning to our foundational principles, we recognized the need to initiate new ventures ahead of the decline in the LCD sector. Materials development is a meticulous, often decadeslong process. Sudden starts may not align with required timelines, so the key is to nurture seeds planted over a decade ago. We expedited this process by strategically incorporating M&A into our approach.

Iriyama It might be easy for scholars to recommend more strategic business exploration. But in reality, it’s quite challenging because it’s time consuming. Typically, companies need to outline a vision 20 to 30 years into the future, continually making small investments and gradually finding the path to success.

But in today's rapidly changing business landscape, management can't afford to wait 30 years. Therefore, acquiring successful startups is essential to expedite exploration. In such M&A pursuits, what does AGC primarily seek to acquire: businesses or technologies?

Hirai Both. Our strategic ventures encompass the electronics, life sciences and mobility sectors. Within life sciences -- particularly in our services as a Contract Development and Manufacturing Organization (CDMO) for biopharmaceuticals -- we started out by seeding a small business Japan. However, recognizing that the primary market for the CDMO services is in Europe and the United States, we acquired multiple venture companies in these regions to access local markets and establish a strong technological foundation for antibody pharmaceuticals.

Iriyama When I discuss ambidextrous strategy, I'm often asked about how to drive innovation. Looking at successes around the world, a substantial number of them emerged from M&As. For instance, Google acquired Android for its mobile OS and YouTube for its video platform. The trend continues with Meta Platforms (formerly Facebook), which made a strategic move by acquiring Instagram.

Many Western companies maintain dedicated units for ongoing global research, seeking potential venture and technology partnerships. They also have specialized teams focusing on post-merger integration for swift and efficient organizational alignment after a merger or acquisition. In contrast, most Japanese companies face challenges in this domain. Despite having talented leaders, they often lack a systematic approach, relying more on individual talent. This reliance constitutes a notable weakness for Japanese companies.

Iriyama The account of then-CEO Shimamura advocating a return to the company's business roots during that crisis is of great significance. A company starts with a founder's vision, builds a history, then aims for a future within that vision. Effective management entails preserving this legacy and seamlessly passing the baton from the past to the future. Exploration initiatives should align with this guiding spirit.

There are at least three significant reasons why a company should align its exploration with its entrepreneurial roots. Firstly, as previously mentioned, it represents a continuation of the legacy, guiding the company in the right direction. Secondly, it holds the power of persuasion. The founder's vision carries more weight with stakeholders -- including employees, customers, investors and banks -- compared to new visions set forth by current management. Finally, it’s ingrained in the company's DNA. Most global companies leverage and manifest what's in their DNA. Unfortunately, not many Japanese companies are actively implementing this vital approach.

Hirai A pro-challenge mindset is ingrained in our DNA. We consistently encourage employees to embrace challenges, even though this inevitably leads to failures at times. While no one welcomes failures, they provide us with important lessons.

To achieve success, one must experience failure. In my mid-30s, I collaborated with a venture company in Silicon Valley and faced a major setback, resulting in significant losses. It was a costly lesson, but it provided me with valuable knowledge.

Iriyama Management openly acknowledging failures is invaluable, especially in exploration where such failures are inevitable. Success in innovation is achieved only by organizations that embrace and learn from failures.

One of a leader's crucial attributes is making decisions in ambiguous situations where there are no clear-cut answers. This skill comes from ample hands-on experience. Formal education, like having an MBA, is valuable, but dealing with ambiguous situations necessitates practical exposure beyond academia.

How is AGC advancing exploration in strategic business sectors like electronics and mobility, apart from life sciences?

Hirai In those fields, we emphasize leveraging our in-house expertise and engaging in open innovation with customers rather than relying on M&As. It's pivotal for AGC to be the chosen partner when customers embark on groundbreaking ventures. Collaborative development as partners markedly heightens the chance of success.

Iriyama Besides M&As and open innovation, companies utilize avenues like licensing and joint ventures for exploration. I often recommend building an exploration portfolio to guide strategy. This portfolio should align with a company's entrepreneurial spirit, purpose, history, culture and other relevant aspects.

Hirai That is inspiring. We must leverage artificial intelligence and machine learning for faster product development in our ongoing digital transformation, transitioning from computer science to materials informatics. At the same time, maintaining state-of-the-art laboratories is crucial for precise, tangible R&D. Creating an exploration portfolio is essential to showcase how each element aligns with our goals in this area.

Ever since the COVID-19 pandemic began, we've witnessed a series of unforeseen events. In such uncertainty, how should a materials company like ours -- where the process from development to productization is time-consuming -- chart a course?

Iriyama The materials field holds significant potential. As long as industry remains, demand for materials will persist. Digitalization will not replace materials. Instead, their value will likely increase. Materials research can span 20 to 30 years, but quick and insightful adaptation to evolving business needs is also vital. Materials companies need to revisit their business position from various angles and prioritize business initiatives.

Hirai I've gained valuable insights today. Our ambidextrous strategy is still at the halfway point and requires more effort. We consistently invest in developing materials technologies, maintaining them as a reservoir of expertise. Simultaneously, we prioritize agile production capabilities to promptly cater to customer needs. This dual focus on core technologies and agile production embodies our innovative approach.

Iriyama The key lies in ambidextrous strategy, a principle deeply embedded in AGC since its inception and one that serves as a cultural cornerstone. This enduring ethos is not only inspiring for AGC, but also for companies across diverse industries.

Reprinted from editorial advertisement in Nikkei Business Online Edition, November 2023

*Department names and titles are those at the time of the interview.