Innovative glass materials for next-generation mobility

- #Mobility

- #Management Strategies

As the technological revolution continues to move forward, the automotive industry is reimagining automobiles in their entirety. AGC, a world leader in automotive glass, is staying on top of the evolving landscape and reshaping its strategies accordingly. Yoshio Takegawa, president of AGC's automotive division, shared his insights into the company’s strategies for next-generation mobility.

Profile

Yoshio Takegawa

President of Automotive Company Senior Executive Officer at AGC

The automotive industry is in a paradigm shift. The CASE (connected, autonomous, shared and service, electric) trend is driving players in the industry to reimagine the traditional concept of a car. “AGC is committed to expanding our mobility business in this transformative period with our partners as we contribute to the industry's evolution,” said Takegawa.

AGC has the world's top market share in automotive glass and is also the undisputed leader in cover glass for in-car displays, which are growing in size.* But can AGC sustain its top position as the paradigm shifts?

* According to AGC research

“Whether it's an EV or a next-generation car, the allure of glass persists,” says Takegawa. “It will remain essential, visually connecting the interior and exterior of vehicles, though new demands are expected to emerge.” In anticipation of upcoming market needs, AGC’s automotive division is proactively developing glass materials, components and solutions.

But what will the market need in the not-too-distant future?

Yoshio Takegawa, President of Automotive Company Senior Executive Officer at AGC

In electric vehicles, bulky batteries located under the cabin can limit the head clearance for occupants by the fact that they require car floors to be raised. To maintain interior comfort, some EV makers are incorporating panoramic glass roofs that convey a feeling of spaciousness. This roof glass requires excellent heat shielding to optimize battery life -- especially when using air conditioning -- and maximize driving range. Side glass needs solid sound insulation to reduce tire and wind noise, maintaining a quiet interior that is already free from the engine noise found in internal combustion-engine vehicles. There is also the need to maintain a semblance of privacy, with dimming features embedded in the glass that automatically compensate for incoming light and road visibility based on driving conditions.

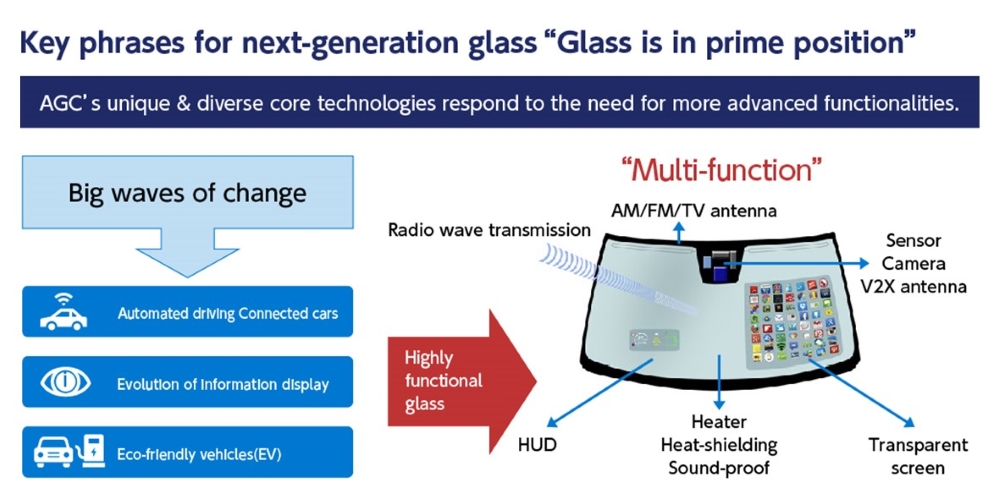

In addition, the rise of self-driving cars will call for extra functionality in automotive glazing. Already, glass components comprise a substantial surface area, strategically arranged in a 360-degree configuration for optimal visibility and passenger comfort. Considering the trend toward panoramic roofs in EVs, this surface area is likely to grow. Hence, automotive glazing is primed to play an even more significant role in incorporating new features and functionality (Figure 1).

Figure 1: AGC’s composite technologies meet high-performance glass demands

With this in mind, AGC is developing materials, parts and solutions for next-generation mobility glass based on three pillars: antennas, sensors and displays.

Antenna functionality is essential for safe cooperative autonomous driving, as the system requires uninterrupted wireless data feeds for gauging distance and 5G communication for accessing cloud services. Embedding antennas into the glass surfaces that face all directions and cover a significant portion of the car's upper body ensures reliable wireless communication. AGC has developed glass that incorporates a 5G antenna, achieving successful and reliable data communication during high-speed driving using millimeter waves. This breakthrough was validated in collaboration with telecom companies NTT Docomo and Ericsson Japan. The ability to embed antenna functionality into significantly large components like automotive glazing enhances flexibility in antenna placement, improving antenna performance without compromising vehicle design and ultimately boosting safety.

Sensors serve as the 'eyes' for autonomous driving, gathering information about the world around the car. Future vehicles are expected to have a range of sensors, including LiDAR (light detection and ranging) and cameras, which will be strategically placed to collect data. However, if these sensors are installed on the outside of the car, it will not only affect vehicle design but also increase air resistance and make the sensors more susceptible to dirt and damage. Installing sensors inside the car obviates these concerns. Glass used for exteriors needs to possess properties that efficiently transmit infrared rays and radio waves in wavelength ranges that normally cannot pass through.

AGC’s glazing helps improve advanced driver assistance systems cameras, using low-distortion glass molding and heater printing to prevent fogging. Furthermore, AGC’s advanced technology allows features such as LiDAR and far infrared (FIR) cameras to be incorporated into automotive glazing to compensate for the limitations of an optical camera.

As for the driver and passenger experience, it is now feasible to integrate display features similar to smartphones into the vehicle interior. With self-driving cars taking over steering, there will be ample opportunities for drivers to view driving status and destination information while on the move or enjoy entertainment such as movies. A location easily visible to passengers is ideal for incorporating a large-area display function.

Figure 2: Antenna, sensor and display: Paving the way for the future of mobility

Still, Takegawa made AGC’s priorities clear. “In next-generation mobility, safety comes first,” he said. “Convenience and comfort are additional values that build on it. Even as we promote multifunctionality, development and production must adhere to this principle."

While some suggest that resin-based materials such as polycarbonate, can replace traditional glass to meet demands for next-generation mobility, AGC is confident that glass components will remain essential to ensure safety and performance over the long term. Resin-based materials are prone to scratches from sand and dust, affecting visibility. They require hard coatings to limit this. Additionally, they degrade over a relatively short time. Glass, however, does not have these issues, offering an excellent balance between functionality and cost.

AGC has a business structure that seamlessly incorporates innovations from its research labs with market trends and customer feedback gleaned from diverse business units. This tightly integrated approach makes for a fast, efficient way to deliver value to customers.

The company’s Mobility Business Development Office is a good example of how well AGC’s structure works. When new proposals and ideas emerge, AGC vets them with partners and customers, eventually refining them or spinning off alternatives.

"Some of our proposals might come across as unexpected or even bold to customers. However, we've noticed that our customers are showing increased interest in them year after year," Takegawa said. "As we share our insights with customers, we start envisioning the materials that will shape the future of next-generation mobility."

To position AGC firmly within the mobility sector, Takegawa outlined in detail the need for the company to shed conventional mindsets: “In the past, we’ve supported automakers by providing products tailored to their specifications, quantity, timing and locations. While this remains important, the rapidly changing industry requires us to go beyond these traditional practices. We need to proactively provide products that anticipate our customer demands by ‘backcasting’ possible scenarios for the future of mobility and society. To make this happen, we must break from a passive mindset. Anticipating trends in next-generation mobility and market regulations will help us develop scenarios where our unique core technologies actually drive the creation of new markets.”

Besides shifting how it thinks, AGC is also bolstering its business structure. The automotive market continues to grow, but there are signs it may be near its saturation point due in part to declining populations in advanced nations. Additionally, nontraditional organizations and startups from different industries are making their presence felt in the sector. The CASE trend is forcing industry players to rethink both the concept of mobility and their business models. This applies not only to automakers but also to parts suppliers. Sticking to old ways does not just make it tough to survive, it also makes it tough to thrive.

Employing an 'ambidextrous management' approach, AGC balances its core businesses against its emerging ones. The glass business of the automotive division recorded over 400 billion yen in sales for fiscal 2022. At the same time, AGC’s next-generation mobility business, along with life science and electronics, is being positioned as a pillar for future growth.

From AGC's perspective, the mobility sector extends beyond passenger cars and commercial vehicles -- to construction machinery, agricultural equipment, drones, railways, ships and more. While the automotive components market is already large, products developed and refined there can extend into other mobility sectors, fostering technological innovation in each. AGC envisions a future in the mobility business that extends conventional expectations, embracing a scope and scale far beyond what most people may currently perceive.

"In the mobility industry, it seems like a second founding period," Takegawa said. "What does society seek in mobility? By going back to basics and contemplating what lies ahead, we can discover new ventures for sustainable growth. We'll move forward with the big picture in mind, but start with small, incremental innovations."

Reprinted from editorial advertisement in Nikkei Business Online Edition, Octorber 2023

*Department names and titles are those at the time of the interview.

®">

®">